For

the fiscal quarter ending February 28, the good news was that FedEx reported

revenue increases in each of its divisions. While total revenue increased 4% to

$11bn, operating income plummeted 28% to $589m.

Most concerning remains the Express division, which contributes over 60% of total revenue for the company. Express revenue increased 2% to $6.7bn but operating income declined 66% to $118m. According to FedEx, customers continued to shift to lower-yielding services. For the quarter, International Express Export revenue increased 2% with much of the increase due to International Economy and International Domestic - International Priority service declined 4% to $1.6bn while International Economy increased 8% to $491m and International Domestic increased 63% to $342m. It should be noted that rate increases played a major role in the increase in revenue for International Economy and International Domestic.

Most concerning remains the Express division, which contributes over 60% of total revenue for the company. Express revenue increased 2% to $6.7bn but operating income declined 66% to $118m. According to FedEx, customers continued to shift to lower-yielding services. For the quarter, International Express Export revenue increased 2% with much of the increase due to International Economy and International Domestic - International Priority service declined 4% to $1.6bn while International Economy increased 8% to $491m and International Domestic increased 63% to $342m. It should be noted that rate increases played a major role in the increase in revenue for International Economy and International Domestic.

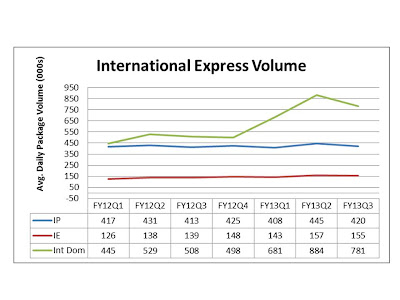

Comparing average daily volumes for each of the

international express service offerings, it appears International Economy (IE)

has steadily increased each quarter since the beginning of fiscal year 2012,

with a slight dip for third quarter. International

Priority (IP) has remained fairly steady for the same comparable time period.

International Domestic (Int Dom), on the other hand, has increased greatly

since first quarter of fiscal year 2012 but a sharp drop in average daily

volumes was noticeable on a quarter-to-quarter comparison from second quarter to

third quarter of the present fiscal year.

This drop may be due to declining demand within the domestic European

market.

Capacity remains an issue as the company noted in its

earnings press release that it plans to decrease capacity to and from Asia and “aggressively

manage traffic flows to place low yielding traffic in lower cost networks.”

Domestically, US Express package revenue was $2.8bn,

representing almost no change when compared to same period the previous year.

Average daily volume changed little when compared to the same period the

previous year as well. Clearly, there is very little growth in the US market,

hence, the company’s plan to retool its domestic network.

For its two other divisions, FedEx Ground reported revenue

of $2.7bn, an 11% increase. Like previous quarters, the increase was due to the

growth in ecommerce and its SmartPost offering. SmartPost average daily volume increased 26%. Operating income increased slightly while

operating margin was 17% compared to 18.8% from same period the previous year.

FedEx Freight revenue increased ever so slightly to $1.2bn,

however, the good news for this division is that its operating income was $4m

compared to a $1m loss from the same period the previous year.

As mentioned previously in this brief, FedEx is working to

right-size its network and noted "In early February, a number of officers

and managing directors, primarily at FedEx Services and FedEx Express, accepted

voluntary buyouts, and on February 15, thousands more team members were

notified of their eligibility for the buyout program. This program is one of

the first steps in a process that will help FedEx Express achieve necessary

cost structure reductions and improved efficiency."

It seems not only the global economy is affecting FedEx

earnings but also the shift away from the use of airfreight as well as global tradelane

shifts. Interesting to note that on the same day the company announced plans to

reduce capacity on the transpacific tradelane, DHL made an announcement that it

was adding capacity in Penang, Malaysia that will also connect to its Hong Kong

to Los Angeles lane.